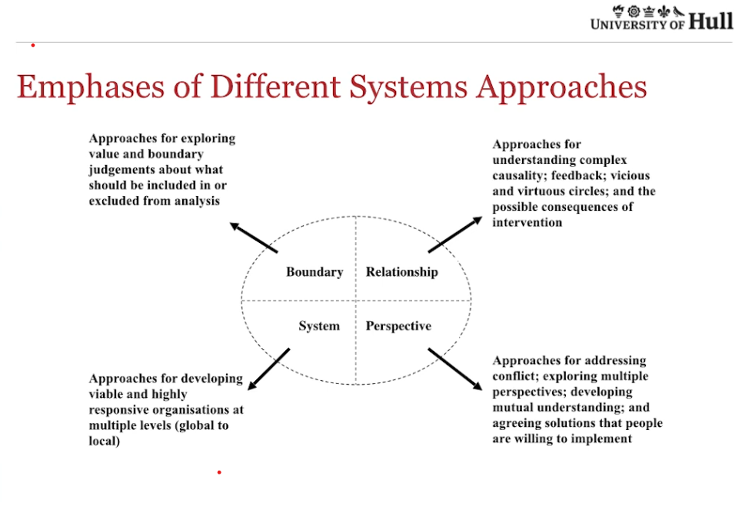

Open Banking is one step on a continuum of Financial Sector Digital Transformation. It, and competition from Fintechs has had profound, transformative effects on banking. These changes originating from European political and social concerns and assumptions, regarding limiting the power of large corporations. As well as, external imposition of digital transformation, from unrelated regulations ensuing from the global financial crisis. Together these factors, facilitated the Data Ecosystem that is Open Banking. (Arner, Buckley, & Zetsche, 2021) Industry responded to changes in boundaries, relationships, and systems using Systems Thinking resulting in new perspectives on collaboration and co-petition.

One of the people lending their thinking to this change is Dr G Mitdgley – Cornell University in the Systems Thinking v2.0 conference in 2014.

It states : In developing countries traditional retail banking was inaccessible, unaffordable, and inflexible. (Mas, 2011)The rapid adoption of cellular devices, innovative society and permissive governance saw innovation in wallet-based mobile money platforms such as MPESA, spread rapidly across Africa and Asia. Adoption pace and scale drove Cloud Computing adoption. Enabling elastic scaling, leveraging of Platform as a Service to accelerate development, deployment and functionality. These apps are profitable where banks could not afford to serve. (Stulz, 2019)

Banks and mobile network operators were unwilling, and largely unable to share data. FinTech’s responded by screen scraping, and storing credentials, with concomitant risk. Regulators imposed rules required for functioning data ecosystems to control this chaotic innovation. In 2017 the UK Competition and Markets Authority (CMA), directed the biggest banks to publish Open Data Application Programming Interfaces (APIs). (Open Banking Limited, 2023) By enforcing Governance of data ecosystems regulators have triggered development of standardised API capabilities in Core Banking platforms, enabling and indeed imposing Digital Transformation on banks. Unlike Oil, Data is infinitely reusable, at close to zero marginal cost.

Data interchange triggered positive developments such as the Kenya Commercial Bank (KCB), merging MPESA and transactional lending while assuming a different role as a platform user. (Gozman, Hedman, & Sylvest, 2018) Success meant taking on millions of retail customers and transforming the bank, the Kenyan economy and the lives of millions of previously un-bankable people. Bank branches are still uncommon in rural East Africa, but the banks are now everywhere there is a mobile phone. (Ondiek, 2021)

The ability to extend the system automation across infrastructure, application and enterprise boundaries depends on interfaces that are different to the traditional banking approach. By 2017, APIs were the next big thing. AWS invented the API enabled cloud services model as the “operating model of the internet”. Companies raced to become API enabled and to adopt Cloud Computing to increase agility. Core Banking systems have rapidly implemented Open Banking REST APIs extending access to any authorised participant. This enables a platform business model and holistic data ecosystem Consumers benefit from choice, and convenience. Despite the interdisciplinary nature and inherent complexity, Data Ecosystems are gaining adoption and will mature and continue to generate value. (Heinz, Benz, Fassnacht, & Satzger, 2022)

The emancipatory intent of Open banking is to democratise means of production and means of access. Putting control over access to data, and choice about how it is used, in the hands of the customer has both enabled, and constrained customers and industry. Predictably, open access to data, increases the surface of attack resulting in breaches. To avoid cost and complexity the ecosystem has to develop such that safety is an emergent characteristic. Benefiting from convenience, and choice and functional empowerment, but there is also a social, time and monetary cost. Regulations made it onerous and complicated for the customer and the service providers. The requirement for Digital fluency will exclude some people, few countries can afford educational initiatives like JISC.

If all innovation resources are directed to the high-tech aspect of banking, who will serve those who don’t have access?

References

Arner, D. W., Buckley, R. P., & Zetsche, D. A. (2021). Open Banking, Open Data and Open Finance: Lessons from the European Union. UNSW Law Research Paper No. 21-69. Retrieved from https://papers.ssrn.com/sol3/Papers.cfm?abstract_id=3961235

Gozman, D., Hedman, J., & Sylvest, K. (2018). OPEN BANKING: EMERGENT ROLES, RISKS & OPPORTUNITIES. Association for Information Systems. AIS Electronic Library (AISeL). Retrieved from https://aisel.aisnet.org/ecis2018_rp/183

Heinz, D., Benz, C., Fassnacht, M., & Satzger, G. (2022). Past, Present and Future of Data Ecosystems Research: A Systematic Literature Review. Pacific Asia Conference on Information Systems (PACIS). AIS Electronic Library (AISeL). Retrieved from https://aisel.aisnet.org/pacis2022/46

Mas, I. (2011). WHY ARE BANKS SO SCARCE IN DEVELOPING COUNTRIES? A REGULATORY AND INFRASTRUCTURE PERSPECTIVE. Critical Review, 135-145.

Ondiek, D. O. (2021). Influence of Digital Technology on the Performance of Kenya Commercial Bank. University of Nairobi. University of Nairobi. Retrieved from http://erepository.uonbi.ac.ke/bitstream/handle/11295/160911/Ondiek_Influence%20of%20Digital%20Technology%20on%20the%20Perfomance%20of%20Kenya%20Commercial%20Bank.pdf?sequence=1&isAllowed=y

Open Banking Limited. (2023, 03 10). Regulatory – Open Banking . Retrieved from Open Banking : https://www.openbanking.org.uk/

Stulz, R. M. (2019). FINTECH, BIGTECH, AND THE FUTURE OF BANKS. NATIONAL BUREAU OF ECONOMIC RESEARCH. Cambridge: US NATIONAL BUREAU OF ECONOMIC RESEARCH. Retrieved from http://www.nber.org/papers/w26312